COVID-19 has caused a market crash, with many portfolio and 401k owners losing significant value in their holdings, starting when the DOW lost 2,000+ points in a single day. Many small-medium sized businesses, which account for a majority of American jobs, have massive strain on short-term revenues. With no exaggeration, millions of Americans have filed for unemployment because this extensive list of corporations, airports, sports leagues and more, that have executed mass layoffs in March and April.

Despite this short-term crash, we are not in a recession (yet). A recession is defined as two consecutive quarters of negative GDP and economic growth. In this survey, 74% of economists see a US recession by 2021, so let’s accept this as an assumption for the rest of this article.

“When times are good, you should advertise. When times are bad, you must advertise”

McGraw–Hill Research Team

Many airlines, travel companies, hotel chains, resorts, national sports teams, and other organizations are currently non-operational. All of these companies have drastically reduced, if not completely terminated, all advertising. This is important for currently operational brands and companies to understand, as there’s many implications this has on all advertising channels.

I’ll kick this off with a famous example from the 1990-91 recession:

In 1990, Pizza Hut and Taco Bell took advantage of McDonald’s decision to drop its advertising and promotion budget. As a result, Pizza Hut increased sales by 61%, Taco Bell’s sales grew by 40% and McDonald’s sales declined by 28%. Of course there’s nuance to this story, but during this time there were no major pivots or changes in business planning outside of advertising.

There are four major reasons why every company must continue to advertise during this COVID-19 pandemic (and any recession):

Regardless of your employment status, you are either working and/or living exclusively from home. This creates more computer and mobile device screen-time, for either work or pleasure. Americans do not want to leave their house, but still have a demand for buying necessities and accessories. News sites and online retailers are seeing all-time high daily traffic.

Travel companies and sports leagues have either completely halted, or drastically decreased their advertising spends for both direct response and brand awareness. The NBA, NFL, ATP, and other national sports leagues have also paused their advertising, unaware of when they will be able to resume their events. The entertainment industry has also taken a hit, as large gatherings are illegal in 42 states.

Because of this, many media outlets are quite literally going extinct, especially the outlets that have not adapted to the online content news model. 19 print newspapers have been suspended in Michigan. Time Out and Stylist magazines have halted production. Alternative weeklies have made mass layoffs in the US and Canada. On Monday, Digiday reported that 88% of legacy and digital publishers surveyed expect to miss their business targets this year.

This also carves out massive opportunity for large advertisers during recessions, as advertising space is cheaper. The famous rise in marketshare of Taco Bell and Pizza Hut over McDonalds in 1990-1991 is a perfect example of this.

In a study of U.S. recessions, McGraw-Hill Research analyzed 600 companies covering 16 different SIC industries from 1980 through 1985. The results showed that business-to-business firms that maintained or increased their advertising expenditures during the 1981-1982 recession averaged significantly higher sales growth, both during the recession and for the following three years, than those that eliminated or decreased advertising. By 1985, sales of companies that were aggressive recession advertisers had risen 256% over those that didn’t keep up their advertising.

On digital platforms like Facebook, Twitter, and Instagram, there is a finite number of impressions that they can sell as advertising space. This is simply their number of users multiplied by the duration they’re on the platform. The long-term trend is that this advertising inventory will only increase in price over time as more and more companies switch their print, radio, and television advertising to digital ads. In both recessions and Black Swans such as COVID-19, this long-term trend is swayed in favor of the advertisers.

During COVID-19, the cost per click on Facebook Ads platform is down 20% from January 2020. This is not a one-time event, as we anticipate this will continue to decrease as the upcoming recession continues.

In an easy to read graph from Common Thread Collective, you can see that advertising are experiencing a higher-than-average Return on Ad Spend (RoAS). With over a 35% increase in RoAS, these are stellar returns for online retailers.

During this pandemic, as well as all recessions, more citizens get laid off and discretionary income decreases. While overall spending decreases, this is the perfect time for growing a loyal audience and user base. While revenues may stay stagnant, you can serve the market in many different ways. Forbes gave the observation that advertisers may offer interest-free loans to finance their goods, which will continue purchases and increase revenue. They can create coupons or special promotions as everyone is looking for a “good deal” on products at these times.

When the economy bounces back, regular pricing can return. Once this bounceback happens, you have nurtured and grown a loyal user base and audience who you can market to, virtually for free. Gravity Group’s major recommendation is to focus on collecting emails and phone numbers at this time. This is the perfect arbitrage, because click-through rates are high, cost per click is low, but propensity to spend is also low which does not hinder this effort. This makes the COVID-19 pandemic, and all recessions, the perfect time to focus on lead generation.

If you have any questions on increasing revenues through COVID-19 and any recession, reach out to Dylan@gravity.group.

Written By: Dylan Ander & Michael Wadden

For several years, ESG Ratings have been used almost exclusively by the impact investing community. Now, as impact investing and conscious capitalism have been integrated into major markets, ESG Ratings are used by start-ups, investors, and international corporations to support their decision making.

Environmental, Social, and Governance (ESG) refers to the three central factors in measuring the sustainability and societal impact of an investment in a company or business. These criteria help to better determine the future financial performance of companies (return and risk). ESG ratings are one of the leading indicators for how companies manage their people, supply chains, decision making processes, etc. during adverse times. These ratings have proven true based on how well companies are handling their COVID-19 response, The Clorox Company being an ESG Leader, outperforming its competitors in Q1 of 2020.

There are several research firms that can calculate an ESG Rating for companies based on a range of factors. Some of the leading ESG research companies include Bloomberg, MSCI, RepRisk, and Sustainalytics. There are some highly regarded ESG-specific firms such as CDP, Oekom, Trucost, and several others.

MSCI Ratings (the biggest ESG market leader) recently became public data in November of 2019 which has major implications on every industry. Previously, only institutional investors had access to this data; they paid tens of thousands to have access. Now anyone can see a company’s ESG rating and decide to invest in that company or not. With this distribution of information in the market, C-Suite executives can no longer hide their company’s lack of social responsibility. If companies are exclusively profit-driven while sacrificing its people and the planet, this will lower their stock price. Executives in 2020 have to be proactive and manage their companies with ESG ratings as a core objective of their business.

At Gravity Group, we use MSCI Ratings to best determine major company decisions and indications of future performance. Although MSCI ratings (currently) only apply to public companies, they provide a rich dataset that helps us optimize our portfolio companies. MSCI ratings allow us to optimize everything from messaging and marketing to business models & fundraising structures. The most actionable facet of MSCI Scores is that they correlate with company valuation. Here’s the breakdown of how MSCI structures its ratings:

MSCI ESG Ratings Methodology Overview

MSCI ESG Ratings aim to answer the following questions:

More specifically, the MSCI ESG Ratings model seeks to answer four key questions about companies:

The MSCI ESG Ratings model has 3 pillars, 10 themes, and 37 ESG key issues that are all factored into a final score. These ratings begin with the three major pillars of Environment, Social, and Governance.

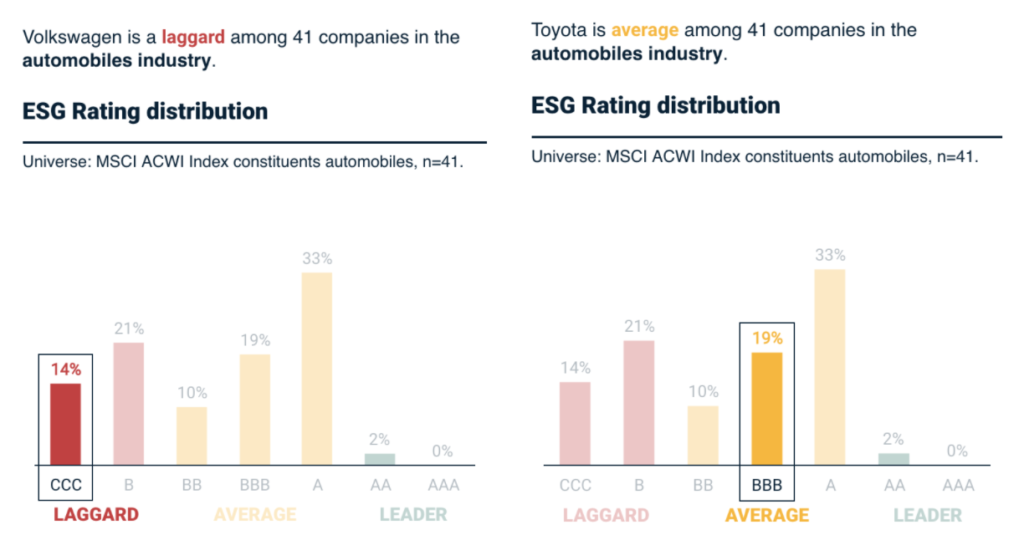

After a final score is calculated, all companies are placed into one of three buckets, ESG Laggard, ESG Average, or ESG Leader. ESG Laggards receive CCC or B ratings while ESG Leaders receive A and AA ratings.

For example, Volkswagen’s ESG Rating is CCC, placing them as an ESG Laggard with the lowest possible rating. Conversely, Toyota Motor Corporation’s ESG Rating is a BBB rating, placing them as an ESG Average. We placed them side-by-side so you can compare.

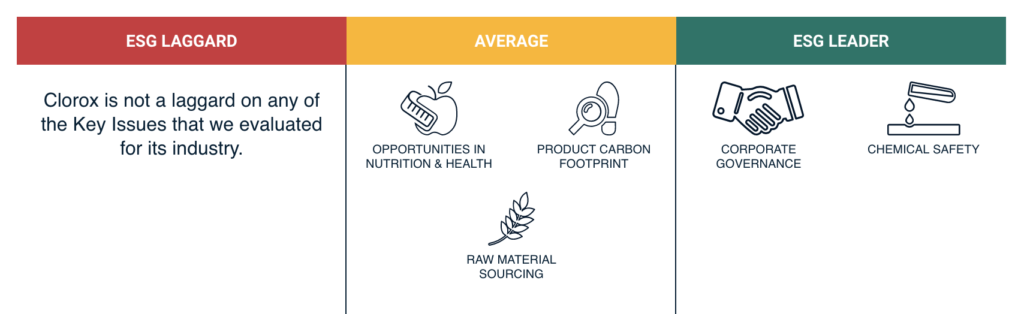

In the height of the spread of COVID-19, there has been a great demand for products made by The Clorox Company (CLX). While this is a driving attribute of the short-term rise in stock price, there has been a steady growth curve since the stock price was at $150. The Clorox Company has a standout ESG rating of AA, as its an ESG Leader. Clorox is an ESG Leader specifically in Corporate Governance and Chemical Safety.

What is also important to know about ESG scores is that they change over time. There are some companies that have made drastic improvements or declines as they make major business decisions. For example, Tesla’s ESG Rating was previously an industry ESG Leader, but they have slid back into the territory of ESG Average.

Gravity Group focuses heavily on applying ESG principles to our portfolio of private companies. Whether Seed Stage or Series B, most of our portfolio companies have intentions of going public or getting acquired by a public company. ESG Momentum (your delta in ESG scores) is crucial for a successful IPO and sustainable stock price. If your company is an ESG Leader in several categories, it justifies a higher acquisition price as an ESG Laggard or ESG Average acquiring your company will see a boost in ESG Momentum. Whether your company falls into the “impact space” or not, this new lens of business is crucial for long-term success of any business.

If your company is looking to leverages ESG Scores for a higher valuation, send an email to Michael@GravityNetwork.earth

Copyright © Gravity Group 2024 All rights reserved.