Business combination ascribes Filament US$176 million in equity value representing US$0.85 per Filament share and reflects a pro forma enterprise valuation of approximately US$210 million; combined company to be listed on Nasdaq

Transaction expected to accelerate the progression of Filament’s botanical psychedelic drug development platform and is anticipated to close in fourth quarter 2023

VANCOUVER, BC and HOBE SOUND, Fla., July 19, 2023 /CNW/ – Filament Health Corp. (OTCQB: FLHLF) (NEO: FH) (FSE: 7QS) (“Filament” or the “Company“), a clinical‐stage natural psychedelic drug development company, and Jupiter Acquisition Corporation (NASDAQ:JAQC) (“Jupiter“), a special purpose acquisition company formed for the purpose of acquiring or merging with one of more businesses, today announced they have entered into a definitive agreement, dated July 18, 2023, for a proposed business combination (the “Business Combination“) to create a new public holding company representing the combined business (“Pubco”) that is expected to be listed on Nasdaq.

“Today’s announcement is an important milestone for Filament as we gain access to the broader capital markets needed to advance our drug development platform,” said Mr. Lightburn. “Filament was founded on the belief that standardized, naturally-derived psychedelic medicines can improve the lives of millions of people suffering from treatable conditions. Partnering with Jupiter brings us a step closer to making this a reality. I would like to thank all those involved in achieving this milestone, including Jupiter, our existing and new investors, and the entire Filament team.”

“We are thrilled to have the opportunity to impact the advancement of psychedelic medicines that will support the treatment of mental health conditions through this combination with Filament. Led by an exceptional management team, Filament is taking a novel approach to psychedelic drug development through natural botanical extracts,” said Mr. James Hauslein, Chairman and Chief Executive Officer of Jupiter. “We are excited by Filament’s plans for its technology, and view this opportunity as a significant value driver for our stockholders.”

The Business Combination

The proposed Business Combination reflects a pro forma enterprise valuation of approximately US$210 million, based on certain assumptions. Consideration will be 100% in the form of shares in Pubco, and the proposed Business Combination is expected to provide at least US$5 million of net proceeds to Pubco. The proposed Business Combination reflects a pre-money equity value of US$176 million for Filament and provides the Filament shareholders and certain other parties a contingent right to receive additional Pubco shares based upon post-closing stock performance. At the closing of the proposed Business Combination, the holders of outstanding Filament shares will receive equity in Pubco valued at US$0.85 per share (subject to adjustments).

Under the terms of the proposed Business Combination, Jupiter will merge with and into a wholly-owned subsidiary of Pubco, and Filament will, pursuant to a statutory plan of arrangement (the “Plan of Arrangement“) under the Business Corporations Act (British Columbia), amalgamate with another wholly-owned subsidiary of Pubco. In addition, pursuant to the proposed Business Combination, the holders of Filament convertible securities will have their convertible securities assumed by Pubco at closing in accordance with the terms of the Plan of Arrangement.

The Board of Directors of Jupiter has unanimously approved the proposed Business Combination.

The Board of Directors of Filament, having received a unanimous recommendation from the special committee of the Board of Directors (the “Filament Special Committee“) in favour of the proposed Business Combination, has determined that the proposed Business Combination is in the best interests of Filament, and resolved to recommend that Filament securityholders vote in favour of the proposed Business Combination (with Mr. Lightburn declaring his interest in the Business Combination and abstaining from the vote of the Board of Directors of Filament).

Evans & Evans, Inc. was appointed as an independent financial advisor to the Filament Special Committee, and provided a fairness opinion to the Filament Special Committee stating that, as of the date of such opinion, and based upon and subject to the assumptions, limitations, and qualifications stated in such opinion, the Business Combination and the consideration payable thereunder is fair from a financial point of view to Filament shareholders.

The proposed Business Combination is subject to customary closing conditions, including receipt of all regulatory approvals, court orders from the Supreme Court of British Columbia with respect to the Plan of Arrangement, and the approval of the proposed Business Combination by Filament’s securityholders and Jupiter’s stockholders. The consummation of the proposed Business Combination is anticipated to occur in the 4th quarter of 2023.

Maxim Group LLC is acting as exclusive financial advisor to Filament. Fasken Martineau DuMoulin LLP is acting as Canadian legal advisor and Ellenoff Grossman & Schole LLP is acting as U.S. legal advisor to Filament. Harper Grey LLP is acting as Canadian legal advisor and Greenberg Traurig, LLP is acting as U.S. legal advisor to Jupiter.

Filament directors and management (the “Supporting Securityholders“) have entered into agreements pursuant to which they have committed to vote their respective shares in favour of the proposed Business Combination. The Supporting Securityholders represent in aggregate approximately 42.8% of the outstanding common shares.

The Pubco shares to be issued under the Plan of Arrangement component of the proposed Business Combination to holders resident in the United States have not been registered under the U.S. Securities Act of 1933 (the “Securities Act“) and may not be offered or sold in the United States absent registration or applicable exemption from registration requirements. It is anticipated that any securities to be issued under the Plan of Arrangement component of the proposed Business Combination either will be offered and issued in reliance upon the exemption from the registration requirements of the Securities Act provided by Section 3(a)(10) thereof or will be registered under the Securities Act on Form F-4 (the “Registration Statement“) to be filed by Pubco with the U.S. Securities and Exchange Commission (the “SEC“).

ABOUT FILAMENT HEALTH CORP (OTCQB:FLHLF) (NEO:FH) (FSE:7QS)

Filament is a natural psychedelic drug development company focused on the treatment of substance use disorders. Filament’s proprietary technology platform enables the discovery and delivery of botanical psychedelic medicines for clinical development. The Company is currently generating revenue by out-licensing its lead drug candidate, PEX010, to commercial partners. PEX010 is standardized to provide a precise dose of botanical psilocybin per oral capsule, and is currently being administered in phase 1 and 2 human clinical trials approved by U.S. Food and Drug Administration (“FDA“) and Health Canada. It is currently being studied in 15 clinical trials in North America and Europe via Filament’s network of academic and research institutions for conditions including alcohol use disorder, treatment resistant depression, opioid tapering, and chronic pain. All of the trials are being conducted under the authorization of the applicable governing authority, including, but not limited to, the FDA, Health Canada and European Medicines Agency. The Company believes that, as a botanical drug, PEX010 offers intellectual property benefits versus synthetic drugs due to its complex active pharmaceutical ingredient, as well as a more rapid path into clinical development. Filament is actively pursuing early access schemes around the world and has supplied dozens of Canadian patients via the Health Canada Special Access Program.

Learn more at www.filament.health and on Twitter, Instagram, and LinkedIn.

ABOUT JUPITER ACQUISITION CORPORATION (NASDAQ:JAQC)

Jupiter operates as a blank check company. Jupiter aims to acquire one or more businesses and assets, via a merger, capital stock exchange, asset acquisition, stock purchase, and reorganization.

Important Information About the Proposed Business Combination and Where to Find It

This communication relates to the proposed Business Combination involving Jupiter and Filament. This communication may be deemed to be solicitation material in respect of the proposed Business Combination. The proposed Business Combination will be submitted to Jupiter’s stockholders for their consideration and approval. Pubco intends to file the Registration Statement with the SEC, which will include a proxy statement to be distributed to Jupiter’s stockholders in connection with Jupiter’s solicitation for proxies for the vote by Jupiter’s stockholders to approve the proposed Business Combination and other matters as described in the Registration Statement, as well as the prospectus relating to the offer of the securities to be issued by Pubco in connection with the completion of the Business Combination. Jupiter and Pubco also intend to file other relevant documents with the SEC regarding the proposed Business Combination. After the Registration Statement has been filed and declared effective, Jupiter will mail a definitive proxy statement and other relevant documents to its stockholders as of the record date established for voting on the Business Combination. The proposed Business Combination will also be submitted to the securityholders of Filament for their consideration and approval. Filament intends to file a management information circular in connection with the requisite special meeting of the Filament securityholders (the “Filament Circular“) with respect to the proposed Business Combination and other matters as described in the Filament Circular. The Plan of Arrangement will require the approval of (i) at least 66⅔% of the votes cast by Filament securityholders, voting as a single class; (ii) at least 66⅔% of the votes cast by Filament shareholders, voting as a single class; and (iii) a majority of the votes cast by Filament shareholders present in person or represented by proxy at the Filament special meeting. Filament also intends to seek an interim order (the “Interim Order“) and a final order at hearings in the Supreme Court of British Columbia in order to implement the Plan of Arrangement component of the proposed Business Combination. After the Filament Circular has been reviewed by the NEO Exchange and after the Interim Order has been granted, Filament will mail the definitive Filament Circular and other relevant documents to its securityholders as of the record date established for voting on the proposed Business Combination. JUPITER’S STOCKHOLDERS AND OTHER INTERESTED PERSONS ARE ADVISED TO READ, ONCE AVAILABLE, THE REGISTRATION STATEMENT AND THE PRELIMINARY PROXY STATEMENT/PROSPECTUS AND ANY AMENDMENTS THERETO AND, ONCE AVAILABLE, THE DEFINITIVE PROXY STATEMENT/PROSPECTUS IN CONNECTION WITH JUPITER’S SOLICITATION OF PROXIES FOR ITS SPECIAL MEETING OF STOCKHOLDERS TO BE HELD TO APPROVE, AMONG OTHER THINGS, THE BUSINESS COMBINATION, BECAUSE THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT JUPITER, FILAMENT, PUBCO AND THE PROPOSED BUSINESS COMBINATION.

Jupiter’s stockholders, Filament’s shareholders and other interested parties may also obtain a copy of: (a) the Registration Statement, any amendments or supplements thereto and the preliminary or definitive proxy statement, once available, as well as other documents filed with the SEC regarding the proposed Business Combination and other documents filed with the SEC by Jupiter or Pubco, without charge, at the SEC’s website located at www.sec.gov; and (b) copies of the Filament Circular, the Business Combination Agreement and other documents filed with the Canadian securities regulatory authorities by Filament through the website maintained by the Canadian Securities Administrators at www.sedar.com.

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY, NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE PROPOSED TRANSACTION PURSUANT TO WHICH ANY SECURITIES ARE TO BE OFFERED OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “could,” “continue,” “may,” “might,” “outlook,” “possible,” “potential,” “predict,” “scheduled,” “should,” “would.” “seek,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters, but the absence of these words does not mean that a statement is not forward-looking. Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events or results of operations, and any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. These statements are based on various assumptions, whether or not identified in this press release, and on the current beliefs and expectations of Filament’s, Pubco’s and Jupiter’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by any investor as a guarantee, an assurance, a prediction, or a definitive statement of fact or probability. Although Jupiter and Filament believe that their respective plans, intentions, and expectations reflected in or suggested by these forward-looking statements are reasonable, neither Jupiter nor Filament can assure you that either will achieve or realize these plans, intentions, or expectations. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Filament, Pubco and Jupiter. These forward-looking statements are subject to a number of risks and uncertainties, including (i) the occurrence of any event, change or other circumstances that could give rise to the termination of the proposed Business Combination; (ii) the failure of either Jupiter or Filament prior to the proposed Business Combination, or Pubco after the proposed Business Combination, to execute their business strategy; (iii) the outcome of any legal proceedings that may be instituted against Filament, Pubco or Jupiter or others following the announcement of the proposed Business Combination; (iv) the inability to complete the proposed Business Combination due to the failure to obtain the necessary Interim Order or other required court orders in respect of the Plan of Arrangement in with respect to the proposed Business Combination or the failure to obtain the approval of the shareholders of Filament or Jupiter or to satisfy other conditions to closing; (v) changes to the proposed structure of the proposed Business Combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the proposed Business Combination; (vi) the ability to meet stock exchange listing standards prior to and following the consummation of the proposed Business Combination; (vii) the risk that the proposed Business Combination disrupts current plans and operations of Filament as a result of the announcement and consummation of the proposed Business Combination; (viii) the ability to recognize the anticipated benefits of the proposed Business Combination, which may be affected by, among other things, competition and the ability of Pubco to grow and manage growth profitably, maintain relationships with customers and retain its management and key employees; (ix) costs related to the proposed Business Combination; * failure to comply with and stay abreast of changes in laws or regulations applicable to Filament’s business, including health and safety regulations and policies; (xi)Filament’s estimates of expenses and profitability and underlying assumptions with respect to redemptions by Jupiter’s stockholders and purchase price and other adjustments; (xii) any downturn or volatility in economic or business conditions; (xiii) the effects of COVID-19 or other epidemics or pandemics; (xiv) changes in the competitive environment affecting Filament or its customers, including Filament’s inability to introduce, or obtain regulatory approval for, new products; (xv) the failure to obtain additional capital on acceptable terms; (xvi) the impact of pricing pressure and erosion; (xvii) failures or delay’s in Filament’s supply chain; (xviii) Filament’s ability to protect its intellectual property and avoid infringement by others, or claims of infringement against Filament; (xix) the possibility that Filament, Pubco or Jupiter may be adversely affected by other economic, business and/or competitive factors; (xx) the failure of Filament or Pubco to respond to fluctuations in foreign currency exchange rates; and (xxi) Filament’s estimates of its financial performance; and those factors discussed in documents of Jupiter or Pubco filed, or to be filed, with the SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that none of Filament, Pubco or Jupiter presently knows or that Filament, Pubco and Jupiter currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Filament’s, Pubco’s and Jupiter’s expectations, plans, or forecasts of future events and views as of the date of this press release. Filament, Pubco and Jupiter anticipate that subsequent events and developments will cause Filament’s, Pubco’s and Jupiter’s assessments to change. However, while Filament, Pubco and Jupiter may elect to update these forward-looking statements at some point in the future, Filament, Pubco and Jupiter specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing Filament’s, Pubco’s or Jupiter’s assessments as of any date after the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements.

No Offer or Solicitation

This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act or pursuant to an exemption from the Securities Act. In Canada, no offering of securities shall be made except by means of a prospectus in accordance with the requirements of applicable Canadian securities laws or an exemption therefrom. This press release is not, and under no circumstances is it to be construed as, a prospectus, offering memorandum, an advertisement or a public offering in any province or territory of Canada. In Canada, no prospectus has been filed with any securities commission or similar regulatory authority in respect of any of the securities referred to herein.

Participants in Solicitation

Jupiter, Filament, Pubco and certain of their respective directors, executive officers, and other members of management and employees may, under SEC rules, be deemed to be participants in the solicitations of proxies from Jupiter’s stockholders and Filament’s shareholders in connection with the proposed Business Combination. Information regarding Jupiter’s directors and executive officers is available in its Annual Report on Form 10-K for the year ended December 31, 2022, which was filed with the SEC on March 10, 2023 (the “Annual Report”). Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of Jupiter’s stockholders in connection with the Business Combination will be set forth in Pubco’s proxy statement/prospectus when it is filed with the SEC. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests will be included in the proxy statement/prospectus when it becomes available. Shareholders, potential investors, and other interested persons in respect of Jupiter and Filament should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from the sources indicated above.

SOURCE Filament Health Corp.

For further information: FILAMENT MEDIA RELATIONS, Anna Cordon, Director of Communications, anna@filament.health; INVESTOR RELATIONS, ir@filament.health; JUPITER, James N. Hauslein, Chairman and Chief Executive Officer, jim@hauslein.com

Unbundling financial data through APIs and driving data-driven insights with value-add products in Africa keeps getting more exciting as major players continue to raise more money for scale.

Less than a year after its $3 million seed round, San Francisco- and Africa-based fintech Pngme has snapped up another $15 million for its financial data infrastructure play. The company is also describing itself as a machine learning-as-a-service platform.

Octopus Ventures led the Series A round, with follow-on investment from Lateral Capital, EchoVC, Raptor Group and Two Small Fish Ventures. Other investors like Unshackled Ventures, Future Africa, Lagos-based Aruwa Capital, and The51 participated too. Pngme also received checks from angel investors; some include Hayden Simmons of RallyCap, Plaid’s Dan Kahn, Richard Talbot, ex-COO of RBC Capital Markets and Kyle Ellicott of Intersect VC.

Pngme’s platform caters to fintechs and other financial institutions across sub-Saharan Africa. When the founders, Brendan Playford and Cate Rung, last spoke with TechCrunch, Pngme was heading out of stealth mode in Nigeria, Kenya and Ghana.

Right now, Pngme has three core products for clients in these three markets. In addition to its already known API and mobile SDK, Pngme has added a customer management platform. The company says combining the three products will drive its customers’ adoption and use of personalized user experiences and financial products.

In a conversation with TechCrunch, Playford references building personalized user fintech experiences to what Alipay and WeChat have done in the past couple of years.

When users sign up, both platforms provide the right recommendations on every financial service before offering the right product when they make up their minds.

“It’s a highly data-driven user experience. And every fintech or bank wants to provide that same data-driven user experience. From instant loans or savings, or overdrafts, or whatever it might be, it’s all just like a user experience around a product,” Playford said, referring to both Chinese super-app juggernauts. “If you get to the core of all of the business problems for financial institutions, they’re looking at doing two things. One is they’re looking at lowering their customer acquisition costs. And then they’re looking at increasing the lifetime value of their customers.”

Playford says Pngme wants to mirror this playbook. But why has it become important for the company all of a sudden?

Most African financial institutions and fintechs are racing to offer fully customized user experiences and financial products tailored to their customers’ needs. To fuel these products and user experiences, data infrastructure is needed. Machine learning models are supposed to be trained to acquire, retain and maximize the lifetime value of a customer.

These processes can be expensive and time-consuming, leaving them with the difficult task of choosing between building the infrastructure or serving their customer.

Pngme allows financial institutions and fintechs to collect and aggregate financial data at scale. The company says its mobile SDK and data processing pipelines collect alternative financial data and unify it with other data sources to create a holistic picture of an individual’s financial behavior.

“The pain point we solve is the cost of building the infrastructure is very high. And the data science, the data engineering talent, just globally is really hard to find. So building a data infrastructure as a service works really well because it’s a subscription to get those services which you’d normally need a five- or six-person team to build this infrastructure.”

The close of Pngme’s Series A brings its total investment to $18.5 million, making it the most funded in this fintech category across the continent. Other prominent startups include South African-based Stitch, and Nigeria’s Okra, Mono and OnePipe.

Although each platform has morphed into providing more complex data offerings, Playford says one of the important things Pngme has considered since February is clearly distinguishing itself from these other platforms.

“What we do is that we’ve kind of really differentiated ourselves to be not just collecting the data that we can see but also, we can connect to Mono data, Okra data, and we can connect with banks’ data. We essentially merge all that data and then put machine learning models on top for the clients. That can be predictive credit models, segmentation models and really positioning ourselves as a data processing infrastructure for banks and fintechs.”

Playford’s explanation of how he thinks Pngme is different resonates with the way other founders think of their own platforms. But time will tell how long these products can keep being dissimilar.

Pngme’s proposition has found traction with some unnamed tier-one banks in Nigeria and South Africa; fintechs Kuda, Umba, Renmoney, CredPal and credit bureaus like TransUnion Africa.

Pngme will use the investment to acquire more customers, it says. One way the company plans to make this happen is by expanding its executive team. Pngme is hiring Lorraine Kageni Maina as the CSO and Nick Masson as the CTO.

Alongside key executive hires, Pngme is expanding its data science, engineering and sales teams globally. COO Rung says Pngme’s infrastructure has processed billions of data points from hundreds of financial institutions across sub-Saharan Africa. The next plan is to double down on its Insights Library product and expand its third-party data connections to other markets over the next year.

For Octopus Ventures, the lead investor in this round, Pngme shows the need for actionable data to drive the explosion of digital fintech services for Africans.

On why the VC firm invested, Tosin Agbabiaka said, “The elegance of the technology solution, combined with an exceptional team and strong market traction with large institutions underlines our belief that Pngme will power the next generation of financial services in Africa, helping to give millions of more people access to banking and lending.”

Original Post: TechCrunch

Vancouver, British Columbia–(Newsfile Corp. – December 10, 2020) – The Very

Good Food Company Inc. (CSE: VERY) (OTCQB: VRYYF) (FSE: 0SI) (“VERY” or the

“Company”), a progressive creator of innovative plant-based food products, is

pleased to announce record sales in November due to highly successful

Thanksgiving, Black Friday and Cyber Monday e-commerce sales promotions.

November Record Monthly Revenue

VERY achieved a new record for monthly sales in November 2020 of $782,790, an

increase of 582% over November 2019 due to increased e-commerce sales

attributable to American Thanksgiving along with Black Friday and Cyber Monday

sales promotions.

E-commerce sales in November were $600,671 resulting from 6,258 orders, an

increase of $292,486 from the prior month, and $550,429 compared to November

CEO Mitchell Scott commented: “We are very pleased with the results of

November’s e-commerce sales promotions. We will be rolling out new marketing

initiatives in the New Year to target existing and new customers in both our

e-commerce and wholesale sales channels as we work to expand our production

and distribution capabilities with the commissioning of the Rupert facility.”

Extension of Marketing Agreement

The Company also announced today that it has extended its agreement with

Gravity Accelerator PBC (“Gravity”), who has provided search engine

optimization services to VERY since August 2020. As compensation for their

services, Gravity will receive a monthly consulting fee in the aggregate

amount of US$50,000 of which US$30,000 is payable through the issuance of

common shares of the Company and US$20,000 is payable in cash. The number of

shares issuable will be determined based on the closing price on the last

trading day prior to the date of Gravity’s monthly invoice less a 10%

discount. All shares issued to Gravity will be subject to a hold period of

four months from the day of issuance.

About The Very Good Food Company

The Very Good Food Company Inc. is an emerging plant-based food technology

company. Our mission is to use progressive food technology to create

plant-based meat and other food products that are delicious while maintaining

a wholesome nutritional profile. To date we have developed a core product line

under The VeryGood Butchers brand.

For further information, please contact:

Mitchell Scott

Chief Executive Officer and Director

Kevan Matheson

Corporate Communications and Investor Relations

Email: invest@verygoodbutchers.com

Phone: +1 855-472-9841

Neither the Canadian Securities Exchange nor its Market Regulator (as defined

in the policies of the Canadian Securities Exchange) accept responsibility for

the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains forward-looking information. Such forward-looking

statements or information are provided for the purpose of providing

information about management’s current expectations and plans relating to the

future. Readers are cautioned that reliance on such information may not be

appropriate for other purposes. Any such forward-looking information may be

identified by words such as “proposed”, “expects”, “intends”, “may”, “will”,

and similar expressions. Forward-looking information contained or referred to

in this news release includes, but is not limited to: the expected timing for

commencement of operations at the Rupert Facility, the Company’s efforts and

ability to build its production and distribution capabilities.

Forward-looking statements or information are based on a number of factors and

assumptions which have been used to develop such statements and information,

but which may prove to be incorrect. Certain assumptions in respect of

continued strong demand for our products; ; that added production capacity

will enable us to increase our sales volume, that we do not experience

material interruptions or supply chain failures as a result of COVID-19, our

ability to retain key personnel, and changes and trends in our industry or the

global economy are material assumptions made in preparing forward-looking

statements or information and management’s expectations. Although the Company

believes that the expectations reflected in such forward-looking statements or

information are reasonable, undue reliance should not be placed on

forward-looking statements because the Company can give no assurance that such

expectations will prove to be correct. Factors that could cause actual results

to differ materially from those described in such forward-looking information

include, but are not limited to: negative cash flow and future financing

requirements to sustain operations; dilution; limited history of operations

and revenues and no history of earnings or dividends; competition; economic

changes; and the impact of and risks associated with the ongoing COVID-19

pandemic including the risk of disruption at the Company’s facilities or in

its supply and distribution channels. The forward-looking information in this

news release reflects the current expectations, assumptions and/or beliefs of

the Company based on information currently available to the Company.

Any forward-looking information speaks only as of the date on which it is made

and, except as may be required by applicable securities laws, the Company

disclaims any intent or obligation to update any forward-looking information,

whether as a result of new information, future events or results or otherwise.

The forward-looking statements or information contained in this news release

are expressly qualified by this cautionary statement.

Corporate Logo

To view the source version of this press release, please visit

https://www.newsfilecorp.com/release/69957

(c) Copyright Newsfile Corp. 2020

COVID-19 has caused a market crash, with many portfolio and 401k owners losing significant value in their holdings, starting when the DOW lost 2,000+ points in a single day. Many small-medium sized businesses, which account for a majority of American jobs, have massive strain on short-term revenues. With no exaggeration, millions of Americans have filed for unemployment because this extensive list of corporations, airports, sports leagues and more, that have executed mass layoffs in March and April.

Despite this short-term crash, we are not in a recession (yet). A recession is defined as two consecutive quarters of negative GDP and economic growth. In this survey, 74% of economists see a US recession by 2021, so let’s accept this as an assumption for the rest of this article.

“When times are good, you should advertise. When times are bad, you must advertise”

McGraw–Hill Research Team

Many airlines, travel companies, hotel chains, resorts, national sports teams, and other organizations are currently non-operational. All of these companies have drastically reduced, if not completely terminated, all advertising. This is important for currently operational brands and companies to understand, as there’s many implications this has on all advertising channels.

I’ll kick this off with a famous example from the 1990-91 recession:

In 1990, Pizza Hut and Taco Bell took advantage of McDonald’s decision to drop its advertising and promotion budget. As a result, Pizza Hut increased sales by 61%, Taco Bell’s sales grew by 40% and McDonald’s sales declined by 28%. Of course there’s nuance to this story, but during this time there were no major pivots or changes in business planning outside of advertising.

There are four major reasons why every company must continue to advertise during this COVID-19 pandemic (and any recession):

Regardless of your employment status, you are either working and/or living exclusively from home. This creates more computer and mobile device screen-time, for either work or pleasure. Americans do not want to leave their house, but still have a demand for buying necessities and accessories. News sites and online retailers are seeing all-time high daily traffic.

Travel companies and sports leagues have either completely halted, or drastically decreased their advertising spends for both direct response and brand awareness. The NBA, NFL, ATP, and other national sports leagues have also paused their advertising, unaware of when they will be able to resume their events. The entertainment industry has also taken a hit, as large gatherings are illegal in 42 states.

Because of this, many media outlets are quite literally going extinct, especially the outlets that have not adapted to the online content news model. 19 print newspapers have been suspended in Michigan. Time Out and Stylist magazines have halted production. Alternative weeklies have made mass layoffs in the US and Canada. On Monday, Digiday reported that 88% of legacy and digital publishers surveyed expect to miss their business targets this year.

This also carves out massive opportunity for large advertisers during recessions, as advertising space is cheaper. The famous rise in marketshare of Taco Bell and Pizza Hut over McDonalds in 1990-1991 is a perfect example of this.

In a study of U.S. recessions, McGraw-Hill Research analyzed 600 companies covering 16 different SIC industries from 1980 through 1985. The results showed that business-to-business firms that maintained or increased their advertising expenditures during the 1981-1982 recession averaged significantly higher sales growth, both during the recession and for the following three years, than those that eliminated or decreased advertising. By 1985, sales of companies that were aggressive recession advertisers had risen 256% over those that didn’t keep up their advertising.

On digital platforms like Facebook, Twitter, and Instagram, there is a finite number of impressions that they can sell as advertising space. This is simply their number of users multiplied by the duration they’re on the platform. The long-term trend is that this advertising inventory will only increase in price over time as more and more companies switch their print, radio, and television advertising to digital ads. In both recessions and Black Swans such as COVID-19, this long-term trend is swayed in favor of the advertisers.

During COVID-19, the cost per click on Facebook Ads platform is down 20% from January 2020. This is not a one-time event, as we anticipate this will continue to decrease as the upcoming recession continues.

In an easy to read graph from Common Thread Collective, you can see that advertising are experiencing a higher-than-average Return on Ad Spend (RoAS). With over a 35% increase in RoAS, these are stellar returns for online retailers.

During this pandemic, as well as all recessions, more citizens get laid off and discretionary income decreases. While overall spending decreases, this is the perfect time for growing a loyal audience and user base. While revenues may stay stagnant, you can serve the market in many different ways. Forbes gave the observation that advertisers may offer interest-free loans to finance their goods, which will continue purchases and increase revenue. They can create coupons or special promotions as everyone is looking for a “good deal” on products at these times.

When the economy bounces back, regular pricing can return. Once this bounceback happens, you have nurtured and grown a loyal user base and audience who you can market to, virtually for free. Gravity Group’s major recommendation is to focus on collecting emails and phone numbers at this time. This is the perfect arbitrage, because click-through rates are high, cost per click is low, but propensity to spend is also low which does not hinder this effort. This makes the COVID-19 pandemic, and all recessions, the perfect time to focus on lead generation.

If you have any questions on increasing revenues through COVID-19 and any recession, reach out to Dylan@gravity.group.

Written By: Dylan Ander & Michael Wadden

For several years, ESG Ratings have been used almost exclusively by the impact investing community. Now, as impact investing and conscious capitalism have been integrated into major markets, ESG Ratings are used by start-ups, investors, and international corporations to support their decision making.

Environmental, Social, and Governance (ESG) refers to the three central factors in measuring the sustainability and societal impact of an investment in a company or business. These criteria help to better determine the future financial performance of companies (return and risk). ESG ratings are one of the leading indicators for how companies manage their people, supply chains, decision making processes, etc. during adverse times. These ratings have proven true based on how well companies are handling their COVID-19 response, The Clorox Company being an ESG Leader, outperforming its competitors in Q1 of 2020.

There are several research firms that can calculate an ESG Rating for companies based on a range of factors. Some of the leading ESG research companies include Bloomberg, MSCI, RepRisk, and Sustainalytics. There are some highly regarded ESG-specific firms such as CDP, Oekom, Trucost, and several others.

MSCI Ratings (the biggest ESG market leader) recently became public data in November of 2019 which has major implications on every industry. Previously, only institutional investors had access to this data; they paid tens of thousands to have access. Now anyone can see a company’s ESG rating and decide to invest in that company or not. With this distribution of information in the market, C-Suite executives can no longer hide their company’s lack of social responsibility. If companies are exclusively profit-driven while sacrificing its people and the planet, this will lower their stock price. Executives in 2020 have to be proactive and manage their companies with ESG ratings as a core objective of their business.

At Gravity Group, we use MSCI Ratings to best determine major company decisions and indications of future performance. Although MSCI ratings (currently) only apply to public companies, they provide a rich dataset that helps us optimize our portfolio companies. MSCI ratings allow us to optimize everything from messaging and marketing to business models & fundraising structures. The most actionable facet of MSCI Scores is that they correlate with company valuation. Here’s the breakdown of how MSCI structures its ratings:

MSCI ESG Ratings Methodology Overview

MSCI ESG Ratings aim to answer the following questions:

More specifically, the MSCI ESG Ratings model seeks to answer four key questions about companies:

The MSCI ESG Ratings model has 3 pillars, 10 themes, and 37 ESG key issues that are all factored into a final score. These ratings begin with the three major pillars of Environment, Social, and Governance.

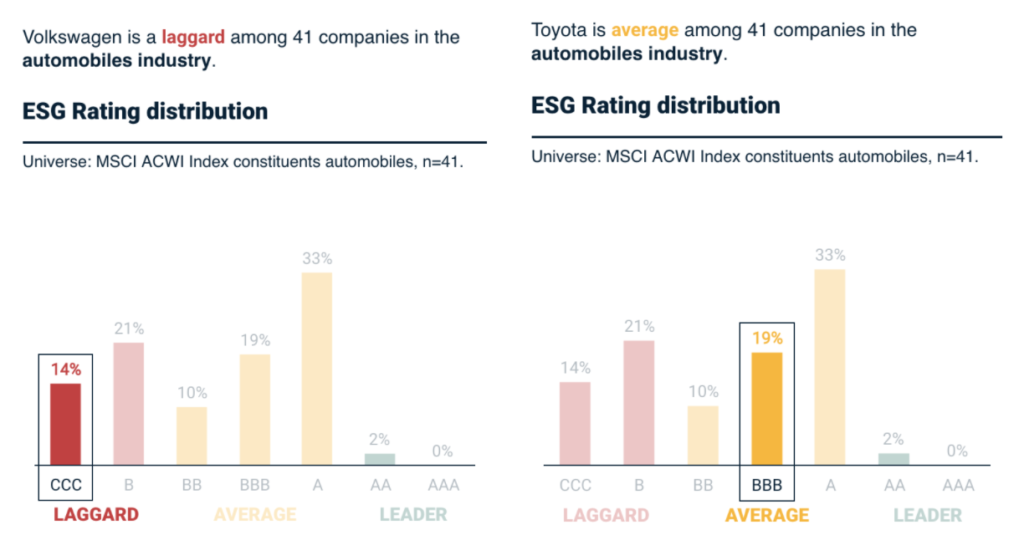

After a final score is calculated, all companies are placed into one of three buckets, ESG Laggard, ESG Average, or ESG Leader. ESG Laggards receive CCC or B ratings while ESG Leaders receive A and AA ratings.

For example, Volkswagen’s ESG Rating is CCC, placing them as an ESG Laggard with the lowest possible rating. Conversely, Toyota Motor Corporation’s ESG Rating is a BBB rating, placing them as an ESG Average. We placed them side-by-side so you can compare.

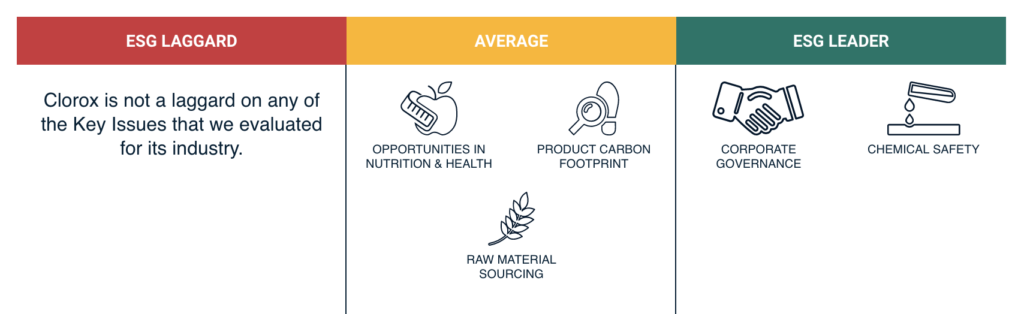

In the height of the spread of COVID-19, there has been a great demand for products made by The Clorox Company (CLX). While this is a driving attribute of the short-term rise in stock price, there has been a steady growth curve since the stock price was at $150. The Clorox Company has a standout ESG rating of AA, as its an ESG Leader. Clorox is an ESG Leader specifically in Corporate Governance and Chemical Safety.

What is also important to know about ESG scores is that they change over time. There are some companies that have made drastic improvements or declines as they make major business decisions. For example, Tesla’s ESG Rating was previously an industry ESG Leader, but they have slid back into the territory of ESG Average.

Gravity Group focuses heavily on applying ESG principles to our portfolio of private companies. Whether Seed Stage or Series B, most of our portfolio companies have intentions of going public or getting acquired by a public company. ESG Momentum (your delta in ESG scores) is crucial for a successful IPO and sustainable stock price. If your company is an ESG Leader in several categories, it justifies a higher acquisition price as an ESG Laggard or ESG Average acquiring your company will see a boost in ESG Momentum. Whether your company falls into the “impact space” or not, this new lens of business is crucial for long-term success of any business.

If your company is looking to leverages ESG Scores for a higher valuation, send an email to Michael@GravityNetwork.earth

Written By: Dylan Ander

Gravity Group has a technology accelerator that works with high-impact and ESG companies that improve the world we live in. The Accelerator’s portfolio companies support the United Nations Sustainable Development Goals (SDGs), simultaneously seeking profitability and high returns for investors. The Co-Founders, Partners and Chief Executives of Gravity Accelerator are luminary entrepreneurs and investors such as Jeremy Nichele (pictured below), Novalena Betancourt Nichele, Richard Andrew Salony, Petr Johanes and Michael Wadden. Gravity’s Executive Team has either founded, lead or held key executive roles in companies such as Accenture Digital, US West Cellular and NextWave among others who have historically returned over $3 Billion to shareholders and generated over $20 Billion in revenue.

Emilio Rivero (left) and Jeremy Nichele (right) CEO of Gravity Group

While over-subscribing its Seed Round, Gravity Accelerator earned equity positions in 17 disruptive portfolio companies, with stand-out companies such as Verses (spatial web), Pngme (providing credit scores and lending in third world countries), and Tsunami XR(reducing carbon emissions through the creation of virtual workspaces).

Emilio Rivero is the Chairman of Envirofit Mexico, a social enterprise that mitigates the negative health effects of cooking on an open fire. Envirofit Mexico has delivered over 300,000 Clean Cook Stoves throughout Latin America saving 4.5 million tons of trees, reducing 4.2 million tons of CO2 in the atmosphere while benefiting 1.2 million people’s long-term health.

Rivero highlights his experience as a Diplomat managing commercial relations within the NAFTA Northwest region. He was a senior advisor to the Office of the Cabinet of Japan for Development and Cooperation International Trade, as well as the International Olympic Committee’s Chief of Protocol dealing with International Dignitary and Security Programs for Olympic Winter Games (VANOC).

Copyright © Gravity Group 2024 All rights reserved.