Written By: Dylan Ander & Michael Wadden

For several years, ESG Ratings have been used almost exclusively by the impact investing community. Now, as impact investing and conscious capitalism have been integrated into major markets, ESG Ratings are used by start-ups, investors, and international corporations to support their decision making.

Environmental, Social, and Governance (ESG) refers to the three central factors in measuring the sustainability and societal impact of an investment in a company or business. These criteria help to better determine the future financial performance of companies (return and risk). ESG ratings are one of the leading indicators for how companies manage their people, supply chains, decision making processes, etc. during adverse times. These ratings have proven true based on how well companies are handling their COVID-19 response, The Clorox Company being an ESG Leader, outperforming its competitors in Q1 of 2020.

There are several research firms that can calculate an ESG Rating for companies based on a range of factors. Some of the leading ESG research companies include Bloomberg, MSCI, RepRisk, and Sustainalytics. There are some highly regarded ESG-specific firms such as CDP, Oekom, Trucost, and several others.

MSCI Ratings (the biggest ESG market leader) recently became public data in November of 2019 which has major implications on every industry. Previously, only institutional investors had access to this data; they paid tens of thousands to have access. Now anyone can see a company’s ESG rating and decide to invest in that company or not. With this distribution of information in the market, C-Suite executives can no longer hide their company’s lack of social responsibility. If companies are exclusively profit-driven while sacrificing its people and the planet, this will lower their stock price. Executives in 2020 have to be proactive and manage their companies with ESG ratings as a core objective of their business.

At Gravity Group, we use MSCI Ratings to best determine major company decisions and indications of future performance. Although MSCI ratings (currently) only apply to public companies, they provide a rich dataset that helps us optimize our portfolio companies. MSCI ratings allow us to optimize everything from messaging and marketing to business models & fundraising structures. The most actionable facet of MSCI Scores is that they correlate with company valuation. Here’s the breakdown of how MSCI structures its ratings:

MSCI ESG Ratings Methodology Overview

MSCI ESG Ratings aim to answer the following questions:

- Of the negative externalities that companies in an industry generate, which issues may turn into unanticipated costs in the medium-to-long term?

- Conversely, which ESG issues affecting an industry may turn into opportunities for companies in the medium to long term?

More specifically, the MSCI ESG Ratings model seeks to answer four key questions about companies:

- What are the most significant ESG risks and opportunities facing a company and its industry?

- How exposed is the company to those key risks and/or opportunities?

- How well is the company managing key risks and opportunities?

- What is the overall picture for the company and how does it compare to its global industry peers?

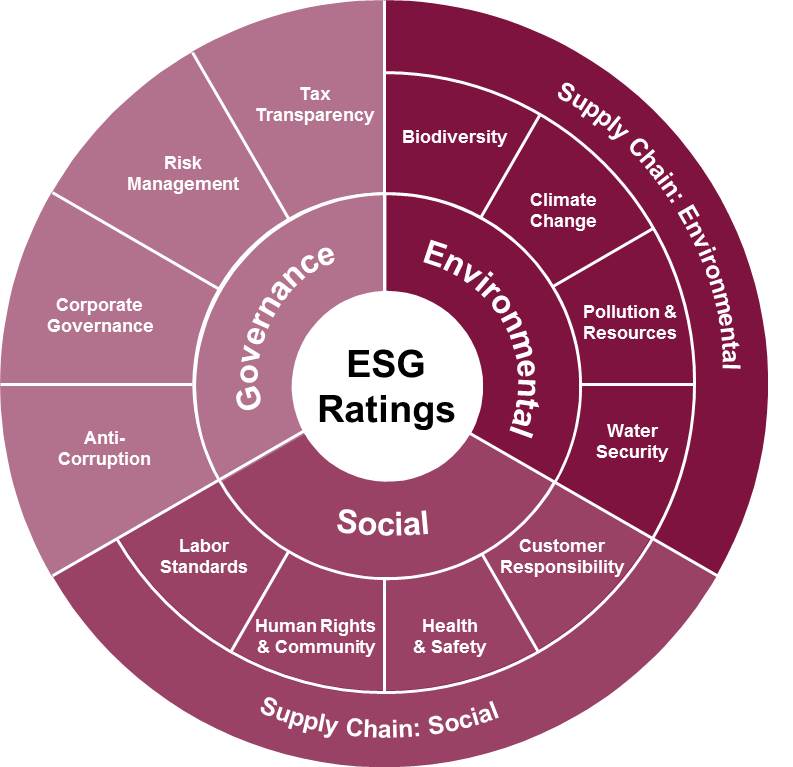

The MSCI ESG Ratings model has 3 pillars, 10 themes, and 37 ESG key issues that are all factored into a final score. These ratings begin with the three major pillars of Environment, Social, and Governance.

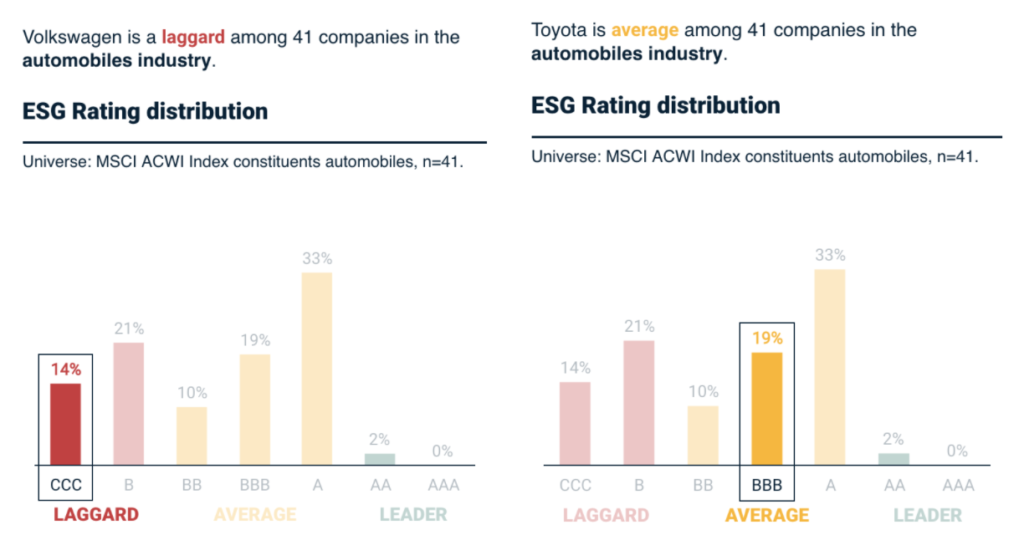

After a final score is calculated, all companies are placed into one of three buckets, ESG Laggard, ESG Average, or ESG Leader. ESG Laggards receive CCC or B ratings while ESG Leaders receive A and AA ratings.

For example, Volkswagen’s ESG Rating is CCC, placing them as an ESG Laggard with the lowest possible rating. Conversely, Toyota Motor Corporation’s ESG Rating is a BBB rating, placing them as an ESG Average. We placed them side-by-side so you can compare.

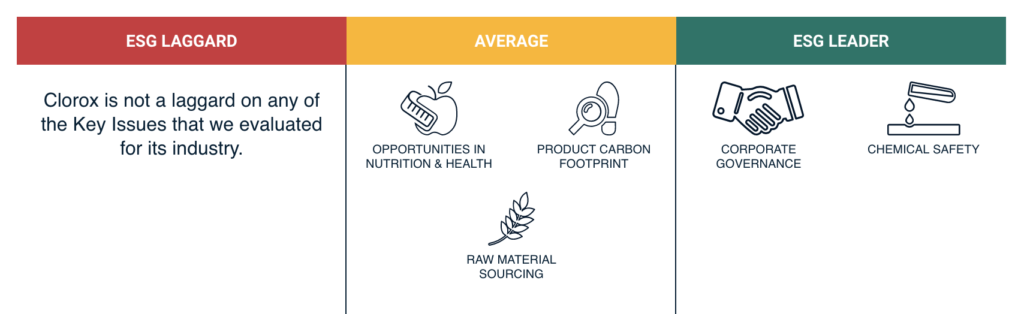

In the height of the spread of COVID-19, there has been a great demand for products made by The Clorox Company (CLX). While this is a driving attribute of the short-term rise in stock price, there has been a steady growth curve since the stock price was at $150. The Clorox Company has a standout ESG rating of AA, as its an ESG Leader. Clorox is an ESG Leader specifically in Corporate Governance and Chemical Safety.

What is also important to know about ESG scores is that they change over time. There are some companies that have made drastic improvements or declines as they make major business decisions. For example, Tesla’s ESG Rating was previously an industry ESG Leader, but they have slid back into the territory of ESG Average.

Gravity Group focuses heavily on applying ESG principles to our portfolio of private companies. Whether Seed Stage or Series B, most of our portfolio companies have intentions of going public or getting acquired by a public company. ESG Momentum (your delta in ESG scores) is crucial for a successful IPO and sustainable stock price. If your company is an ESG Leader in several categories, it justifies a higher acquisition price as an ESG Laggard or ESG Average acquiring your company will see a boost in ESG Momentum. Whether your company falls into the “impact space” or not, this new lens of business is crucial for long-term success of any business.

If your company is looking to leverages ESG Scores for a higher valuation, send an email to Michael@GravityNetwork.earth